The Securities and Exchange Commission (“the Commission” or “the SEC”) is the regulator of the Capital Markets in Zambia. It was established through Cap 354 of the Laws of Zambia and its existence was continued through the Securities Act no. 41 of 2016 (“the Act”).

The Commission’s mandate as prescribed in Section 9 of the Act is to create and promote conditions in the capital markets aimed at ensuring an orderly growth, integrity and development of the capital markets. The SEC Mandate is aligned to international best practice as prescribed in the International Organisation for Securities Commissions (“IOSCO”) principles for Securities Regulation. Section 9 of the Act provides the legal basis for the Commission’s application of the risk-based Supervision approach contained in the SEC RBS Policy. In fulfilling its mandate under the Act, the Commission subscribes to international best practice as prescribed in IOSCO objectives of securities regulation. The IOSCO objectives for securities regulation which are aligned to the SEC mandate are:

- protecting investors.

- ensuring that markets are fair, efficient and transparent.

- reducing systemic risk .

Risk-Based Supervision (RBS) has overtime become the prepotent supervisory approach to regulatory supervision of financial institutions globally. It is a comprehensive, formal structured system that looks to assess risks within the financial system and posed by financial institutions and the extent to which these institutions can manage and mitigate these risks.

RBS is essentially different from compliance-based supervisory approach which mainly centers on the extent to which entities comply/adhere to rules, requirements and directives. Compliance-based supervision (CBS) is a method of regulation which involves checking for and enforcing compliance with rules –legislation, regulations or policies – that apply to an entity.

RBS on the other hand is largely outcomes and principles based. It seeks to assess, through a forward-looking perspective and with use of extensive judgement, the most important risks posed by an institution to the supervisory objectives and also assess the degree to which entities are able to manage and mitigate these risks.

| RBS | CBS | |

|---|---|---|

| Formal Education | Extensive | Low to Moderate |

| Industry Knowledge | Extensive | Low to Moderate |

| Company Knowledge | Extensive | Low to Moderate |

| Ability to apply judgement | Extensive | Low |

| Engagement & Communication across supervisory teams | Extensive | Low |

| Communication Skills | Extensive | Low |

| Management Oversight | Extensive | Low |

| Quality Assurance Process | Extensive | Some |

| Practices (i.e., documented procedures) | Robust framework & Supporting guidance required | Checklist & some guidance |

| RBS - A journey not a destination |

The main characteristics of RBS include;

- Risks are addressed in a systematic way giving priority to what matters most

- RBS is dynamic and forward looking. It creates an environment where risks can be identified early enough and be attended to early.

- RBS supports improved decision making and the most effective use of scarce supervisory resources

- RBS is not confined to firm-facing supervision

RBS has a regulatory prominence of “centering on what matters most” through the assessment of the level of risk in the entities’ business operations and ultimately determining how to reduce the level of risk to what is acceptable or required. With the RBS methodology, entities are monitored for both, compliance with the rules as well as how the entity handles its risk management. Non-compliance and shortcomings noted through the RBS assessment are actioned on in accordance with the appropriate laws and regulations.

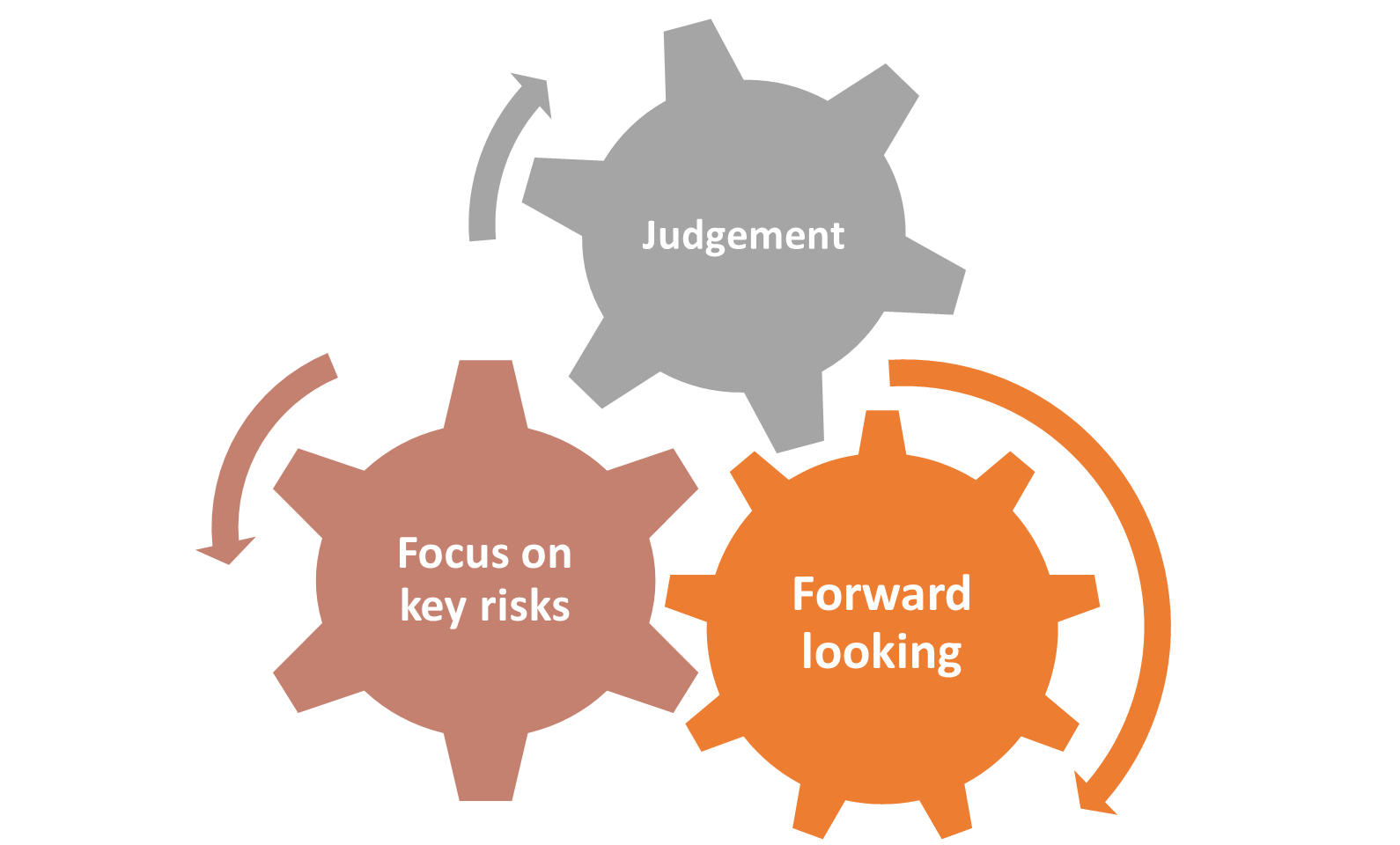

In applying RBS, the Commission is guided by three core principles;

- Principle 1: Use of judgement: The Commission’s supervisory activities are based on judgements reached by Commission staff to assess the inherent risks that CMOs face, the risks that CMOs pose to Commission’s objectives and the adequacy of the CMO’s resources to manage the risks identified and the determination of supervisory responses.

- Principle 2: Focus on key risks: The risk assessment the Commission performs in its supervisory work is focused on identifying key risks posed by a CMO to the SEC’s supervisory objectives. The emphasis on key risks ensures that the Commission allocates resources efficiently to areas with the highest risk. Other risks will be tracked through various monitoring mechanisms.

- Principle 3: Forward-looking, early intervention: Risk assessment is forward-looking and dynamic. This view facilitates the early identification of issues or problems, and timely intervention where corrective actions need to be taken, so that there is a greater likelihood of the satisfactory resolution of issues.

With effect from April 2022, the Commission will migrate the Zambian Capital Markets to RBS as outlined in the SEC RBS Policy.