What we do

Market Supervision is responsible for the following key functions:

The licensing process aims to ensure that only fit and proper organizations and individuals are allowed to operate in the capital market. The licensing, authorization or registration process establishes the regulatory relationship between the SEC and the capital market operator. To this end the Commission has minimum fit and proper requirements that capital markets operators must meet. The Commission has also prescribed the minimum technical competences, qualifications, training and experience that individuals working in capital markets must possess. More importantly, the Commission has put in place procedures to ensure dishonest are not allowed to participate in capital markets.

Once licensed, registered, authorised or recognized, a capital market operator will be supervised by the market supervision team under our supervisory framweork described below.

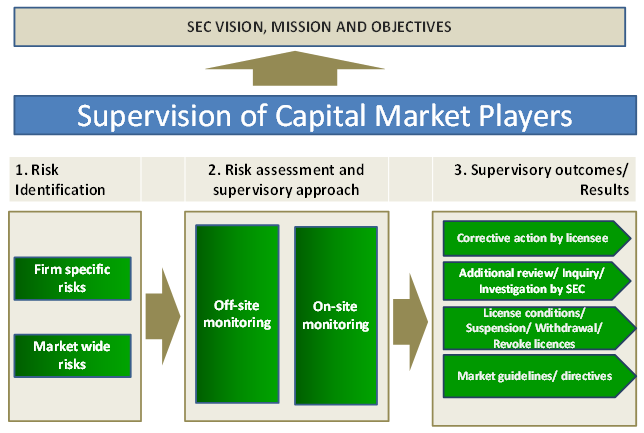

The above functions are undertaken in a supervisory framework which currently primarily compliance based. This means that supervision is largely driven by reviewing how entities are complying with specific requirements of the Securities Act and subsidiary legislation. This comprises a comprehensive licensing and supervisory regime aided by the execution of proactive & effective inspection, compliance and anti-money laundering supervisory programmes. The diagram below summarises our supervisory approach:

The risk assessment and supervisory approach: At this stage the Commission applies supervisory methodologies and tools to identify, assess and monitor the relevant risks of capital market operators. These tools include regulations, early warnings mechanisms; market surveillance; auditor certification; interaction with other regulators; proactive monitoring through off-site monitoring; on-site review. This risk assessment culminates into a risk profile for each operator.

Off-site monitoring: the Commission maintains regular interactions with the operatorsin order to understand their business models, latest plans and the risks inherent in such activities, with a view to identifying and assessing the risks arising from their business activities. The Commission will also use intelligence from different sources, follow up on complaints and self-reported breaches among others. Through consolidating information gathered from various sources, the Commission will form a view of the business profile of the operator.

On-site review: is a key supervisory tool that enables the Commission understand a operator’s business operations, risk management and internal controls, and gauge the level of compliance with relevant laws and regulatory requirements. This also enables the Regulatory Authority to assess the extent operators act with due skill, care and diligence and adopt proper business conduct, procedures and practices in accordance with the relevant laws and regulations.There are four types of on-site review, namely:

- Routine inspection: To check systems and compliance with laws and regulations.

- Special inspection: where operators are suspected to pose imminent risks to the market or to their customers.

- Thematic inspection: to assess the scale and nature of a particular sector-crossing risk

- Prudential visit: to obtain a high level understanding of the operator’s latest business developments, business outlook and how it manages the challenges it faces.

- Findings/ concerns are communicated to the operator: In the event that non- compliance with applicable laws and regulations or control deficiencies have been identified, or where a operator is considered to be running its business aggressively without properly managing the corresponding financial risks.

- Directives to operator: to take prompt and effective remedial actions, or where appropriate, implement contingency plans (such as injection of capital or subordinated loans), to deal with the problems.

- Enforcement: The Department of Legal and Enforcement Services may conduct further enquiry / investigation into the case and, where appropriate, take disciplinary actions (which include reprimands, revocations or suspension of licenses and monetary fines).

- Appointment of external consultants: to conduct internal control review or circularisation of client balances and positions in cases where internal controls are poor and client assets may be exposed to misappropriation risks

- Imposition of licensing conditions: Expeditious restrictive actions will be taken to preserve the client assets and to contain the damage that could be caused by the operator as far as possible.

- Public notices and warnings: the issuance of a notice to restrict the way the operator conducts its business or deals with its property.

- Industry reports/ circulars/ guidelines: the Regulatory Authority generally issues a report, circular and guidelines to remind the industry of particular legal or regulatory requirements and/or to better communicate the expected standards.

The SEC's approach to supervision is also designed to enable it to meet its supervisory obligations in accordance with International Organisation of Securities Commissions (IOSCO) principles and guidelines, where applicable. According to IOSCO the three core objectives of securities regulation are as follows:

- The protection of investors - to promote full disclosure by entities seeking a listing and entities already listed to enable the investing public to make well informed investment decisions;

- Ensuring that markets are fair, efficient and transparent - to reduce the incidence of securities crime and to maintain a level playing field for all investors; and

- The reduction of systemic risk - to foster the stability of market intermediaries.

There are a number of benefits for regulating and supervising the capital markets. These include the following:

- Enhance the credibility of the market and improves market confidence.

- Increase the competitiveness of themarket internationally

- Protect the investing public and regulated entities

- Reduce systemic risk

- Has a stabilizing effect on the economy