To ensure an effective and coordinated design and implementation of NFIS II, five working groups have been established as follows;

Pensions and Insurance working group, having the Pensions and Insurance Authority as Secretariat;

Capital Markets and Environmental, Social and Governance working group, having the Securities and Exchange Commission as Secretariat;

Digital Financial Services and Financial Infrastructure working group, having the Bank of Zambia as Secretariat;

Financial Consumer Protection and Capability working group, having the Competition and Consumer Protection Commission as Secretariat; and

Monitoring and Evaluation, and Research and Data working group, having the Zambia Statistical Agency as Secretariat.

For more information on NFIS II capital markets related activities, please contact info@seczambia.org.zm

As a build up to the National Financial Inclusion Strategy 2017 to 2024, the Government of the Republic of Zambia through the Ministry of Finance and National Planning in collaboration with the three financial sector regulators namely, the Bank of Zambia, Pensions and Insurance Authority and Securities and Exchange Commission, launched the National Financial Inclusion Strategy 2024 to 2028 (NFIS II).

NFIS II aims to create an inclusive and robust financial ecosystem that provides accessible, affordable and sustainable financial products and services to all segments of the population, which help increase their resilience, improve their financial health and build their confidence in the financial system.

As regulator in Zambia’s financial sector, SEC co-develops and co-implements the National Strategy on Financial Education.

The National Strategy on Financial Education (NSFE) Zambia, sets out the framework for providing financial education to the Zambian population.

The overall strategic objective is to have a Zambian population that has improved knowledge, understanding, skills, motivation and confidence to help them secure positive financial outcomes for themselves and their families by 2024.

The programmes which have been selected for inclusion in the NSFE (the priority programmes) are each expected to make a significant difference to financial capability levels at the national level. Between them, the programmes cover a broad range of the population. They comprise a mix of quick wins and longer-term investments.

Priority financial education Programmes are organized around four themes as follows:

The National Strategy on Financial Education for Zambia is underpinned by a number of principles (“the guiding principles”). These principles have been taken into account when selecting financial education programmes for inclusion in the NSFE and will guide how the programmes will be implemented. The guiding principles are as follows:

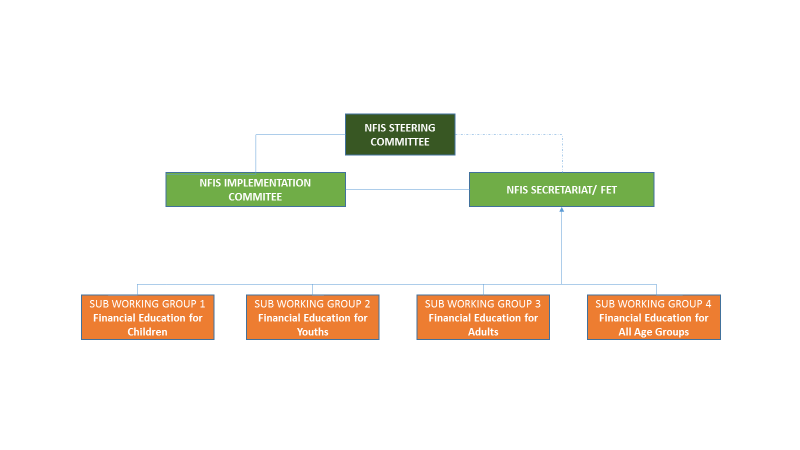

The National Financial Inclusion Strategy (NFIS) Steering Committee provides overall policy guidance for the implementation of the NSFE. Implementation of the NSFE activities are undertaken through the four Sub-Working Groups on: i) Financial Education for Children, ii) Financial Education for Youths, iii) Financial Education for Adults, and iv) Financial Education for All Age Groups. The Sub-Working Groups report to the NFIS secretariat/FET