Securities and Exchange Commission Town Hall Meetings: Engaging the Public on Capital Markets benefits and opportunities.

In March 2021, the Securities and Exchange Commission (SEC) Zambia launched a strategic awareness program aimed at educating the public about the benefits and opportunities available in the capital markets. This initiative was designed to foster growth and participation in Zambia’s capital markets by providing key insights to both the investing and issuing public.

The SEC Town Hall Meetings seeks to offer continuous educational sessions on capital markets to the Zambian public, equipping them with essential knowledge. Key aspects of the Town Hall include:

The Town Halls are held as virtual webinars every last Thursday of every month at 15:00hrs, CAT.

After the event, the SEC extracts the registered participants’ emails and adds them to its database for future communication. Additionally, participants receive the meeting recording and presentation materials directly in their inboxes.

Zambia celebrated its first Financial Literacy Week, a localization of the Global Money Week in 2013. The Global Money Week is a global money awareness celebration that takes place in March every year that was introduced by the Child and Youth Finance International (https://childfinanceinternational.org) to raise awareness on Economic Citizenship and directly engage children and youth worldwide on the issue and is now organised by the OECD/INFE (www.oecd.org). The OECD and its International Network on Financial Education (INFE) support policy makers and public authorities to design and implement national strategies for financial education, individual financial education programmes, while also proposing innovative methods for enhancing financial literacy among the populations of partner countries.

In collaboration with various financial sector regulators, this event focuses on equipping people with essential knowledge and skills to make informed financial decisions, manage their resources effectively, and secure their financial future.

We organize flagship events at secondary and primary schools, bringing students, educators, and community leaders together. These events include competitions and interactive sessions designed to promote saving, budgeting, and investing.

Financial literacy presentations at tertiary institutions cover vital topics such as student loans, credit management, and career planning, providing young adults with the tools they need to make informed financial decisions.

Our public exhibitions feature interactive displays and live drama performances that illustrate real-life financial scenarios, fostering responsible financial behavior among diverse audiences.

Local media outlets and social media platforms are leveraged to extend the reach of our message, ensuring that financial literacy resources are accessible to as many people as possible.

The World Investor Week (WIW) is a public awareness campaign aimed at enhancing investor education and protection. The campaign is led by the International Organisation of Securities Commissions (IOSCO) and implemented by Securities Regulators worldwide. Therefore, the Securities and Exchange Commission (SEC) is responsible for spearheading and coordinating WIW activities in Zambia. In doing so and to ensure maximum outreach, SEC collaborates with various capital markets stakeholders which include (among others); the Capital Markets Association of Zambia, the Lusaka Securities Exchange, stockbrokers, Fund Managers, Investment Advisors (and other Capital Market Operators), Government Agencies and Financial Educators.

As a country, we first commemorated the WIW in 2017 when it was launched by IOSCO and have to date, successfully commemorated the campaign each year.

The objectives of the World Investor Week include:

The Securities and Exchange Commission (SEC) participates in the Zambia International Trade Fair (ZITF), using this premier event as a vital platform to advance its core mandate of investor protection and market development. Through engaging activities, educational sessions, and meaningful stakeholder interactions, SEC continues to promote a deeper understanding of capital markets, foster partnerships, and showcase the opportunities for investment in Zambia’s financial landscape.

The SEC focuses on promoting investor education through interactive workshops, seminars, and educational materials aimed at enhancing public understanding of capital markets and investment opportunities. The Commission also facilitates meaningful dialogues with investors, businesses, regulatory bodies, and the general public to foster collaboration, highlight regulatory initiatives, and attract both domestic and international investment.

As Zambia’s capital markets regulator, SEC’s participation emphasizes its ongoing commitment to driving economic growth, ensuring fair market practices, and advancing the nation’s financial ecosystem through strategic partnerships. The event highlights SEC’s role in shaping a sustainable and prosperous future for Zambia’s economy.

The Securities and Exchange Commission (SEC) participates annually in the Agricultural and Commercial Show as part of its ongoing efforts to promote investor education, capital market development, and stakeholder engagement. The event provides a strategic platform for the Commission to engage with the public, market participants, and other stakeholders in alignment with its mandate and the Capital Markets Master Plan (CMMP).

The Securities and Exchange Commission (SEC) actively participates in the Copperbelt Agricultural, Mining, Industrial Networking Expo (CAMINEX), one of Zambia’s premier trade exhibitions held annually in Kitwe. CAMINEX brings together a diverse group of stakeholders across various sectors—including mining, agriculture, financial services, technology, and manufacturing—providing a dynamic platform for showcasing innovation, fostering dialogue, and exploring investment and partnership opportunities.

The SEC’s presence at CAMINEX positions the Commission as a key player in driving regional and national economic development, highlighting the role of capital markets in supporting production, partnerships, and people-centered growth.

As regulator in Zambia’s financial sector, SEC co-develops and co-implements the National Strategy on Financial Education.

The National Strategy on Financial Education (NSFE) Zambia, sets out the framework for providing financial education to the Zambian population.

The overall strategic objective is to have a Zambian population that has improved knowledge, understanding, skills, motivation and confidence to help them secure positive financial outcomes for themselves and their families by 2024.

The programmes which have been selected for inclusion in the NSFE (the priority programmes) are each expected to make a significant difference to financial capability levels at the national level. Between them, the programmes cover a broad range of the population. They comprise a mix of quick wins and longer-term investments.

Priority financial education Programmes are organized around four themes as follows:

The National Strategy on Financial Education for Zambia is underpinned by a number of principles (“the guiding principles”). These principles have been taken into account when selecting financial education programmes for inclusion in the NSFE and will guide how the programmes will be implemented. The guiding principles are as follows:

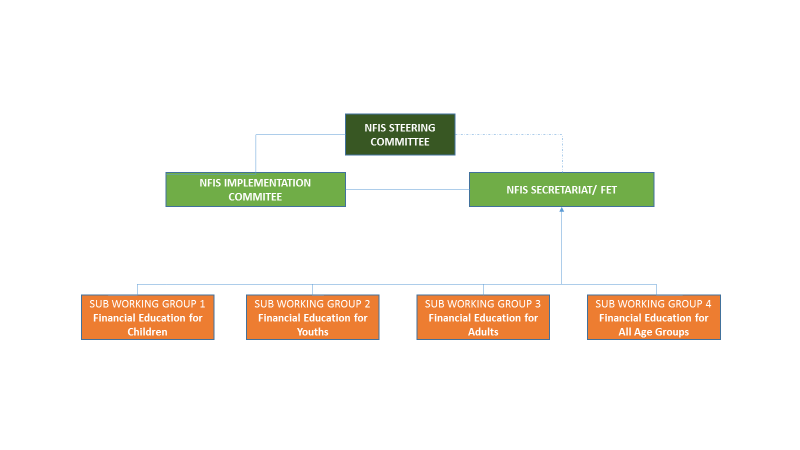

The National Financial Inclusion Strategy (NFIS) Steering Committee provides overall policy guidance for the implementation of the NSFE. Implementation of the NSFE activities are undertaken through the four Sub-Working Groups on: i) Financial Education for Children, ii) Financial Education for Youths, iii) Financial Education for Adults, and iv) Financial Education for All Age Groups. The Sub-Working Groups report to the NFIS secretariat/FET